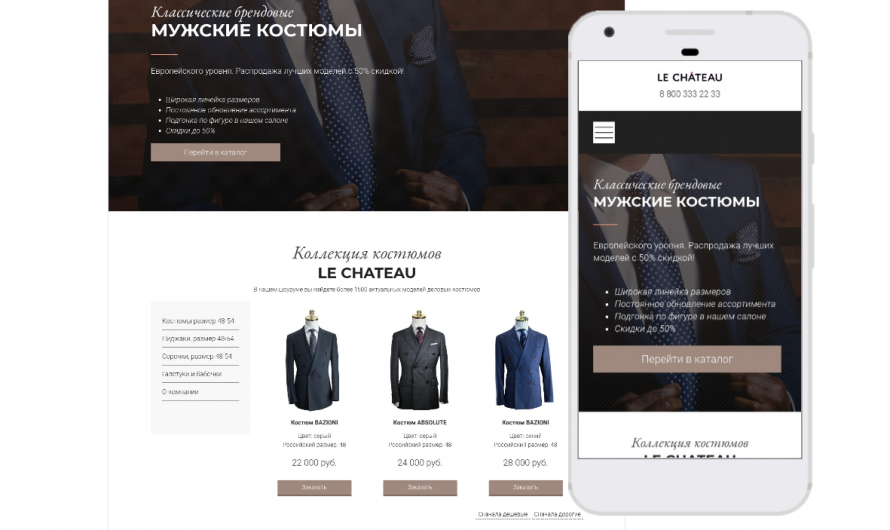

Макет сайта одежды: создание стильного и удобного онлайн-магазина

1. Значение макета сайта одежды для успешного интернет-магазина Макет сайта одежды играет важную роль в создании уникального и привлекательного интернет-пространства для покупателей. Он отражает брендовый …